ITALY CHRONICLES

Latest Posts

New! Italy Photo Contests – Show Off Your Photos of Italy

If you, like me, you think Italy is extremely photogenic, you might be interested to hear that Italy Chronicles is to run photo contests. The

Italian Politics – Still a Mess

Here’s a roundup stroke overview of what’s going on in the decidedly odd world of Italian politics. Broadly, there are three political factions in Italy,

Wild Boar Hunting in Italy

Ever thought about wild boar hunting in Italy? Maybe not but perhaps you might like to. Italy has a bit of a problem with wild

Berlusconi Heart

On Thursday in Italy headlines were dominated by the news that Silvio Berlusconi, a former and controversial prime minister, required an urgent heart operation and had

Money People – The World’s Biggest Problem

What’s that old saying? Ah yes, “money is the root of all evil”. From what is happening in Italy and elsewhere around the world, there

Italian Politics – Still a Mess

Here’s a roundup stroke overview of what’s going on in

Wild Boar Hunting in Italy

Ever thought about wild boar hunting in Italy? Maybe not

Berlusconi Heart

On Thursday in Italy headlines were dominated by the news

Money People – The World’s Biggest Problem

What’s that old saying? Ah yes, “money is the root

Italy

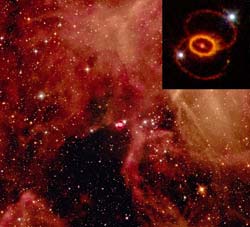

Of Nubile Neutrinos and Tunnels

You may have read recently that tiny weeny little particles called neutrinos are suspected of travelling faster than light. One of the laboratories which is

Men’s Underwear Ad Draws Attention in Italy

I’ve really know idea who came up with the idea of using a sexy young lady to advertise men’s underwear, but the result certainly catches

An Arresting Vote

Alfonso Papa is an Italian politician, and magistrate (or was, he was suspended the other day), who investigators would dearly like to arrest. This honourable

How to Profit from 1 Euro Houses with Airbnb in Italy

Understanding 1 Euro Houses in Italy Unearth the potential of 1 euro houses in Italy. Invest in these affordable properties and turn them into profitable

Visit Sicily with You, Me and Sicily

The other day I got an email from Eszter Vajda about the You, Me and Sicily project she’s working on with Alfred Zappala. The You, Me

Results: Italy Elections 2013

Well, the result is, er, no conclusive result. No single political party or coalition earned enough votes to form a working majority and it’s not

The Great Beauty: Modern Rome in Film

The city of Rome has long been a source of

Timeless Italian Streets

If you ever come to Italy, sooner or later you will come across quaint, narrow Italian alleyways and streets. Some such streets are so narrow, down in Genoa for example, that you can literally stretch out your arms and touch both sides at the same time.

Properties

The Admirable Admiral’s Villa in Taormina

If you know your history pretty well, you may be aware that one of England’s most celebrated Admirals possessed a rather charming villa in the scenic Sicilian town of Taormina.

House For Sale near Milan

Gaetano Salvo, friend and Blog from Italy researcher wants to sell his house. For those who might be interested, or may know of someone or

How to Find Property for Rent in Italy

Maybe you are coming to Italy to work or study here for a while, in which case, you’ll need somewhere to live. If that’s the

The Admirable Admiral’s Villa in Taormina

If you know your history pretty well, you may be aware that one of England’s most celebrated Admirals possessed a rather charming villa in the scenic Sicilian town of Taormina.

How to Find Property for Rent in Italy

Maybe you are coming to Italy to work or study here for a while, in which case, you’ll need somewhere to live. If that’s the

Places to stay in Italy

Chaplin Bed and Breakfast Rome

Perfectly located in a safe and quiet but extremely central Rome neighborhood, the Chaplin Bed and Breakfast Rome is the ideal base for your Roman holiday.

Villa Miller Bed and Breakfast, Puglia, Italy

Located well off the main road in the depths of the Puglia countryside, Villa Miller the only sounds which disturb guests are those of the crickets and the ringing of the bells worn by the areas cow and sheep population.

Casa Villatalla B&B, Liguria

By far the most important members of the Casa Villatalla household are Nellie (an elderly but loveable chocolate Labrador), Bonnie, a fluffy and rather scatty American Spaniel, and Pickle, aneccentric cat who walks like John Wayne.

Chaplin Bed and Breakfast Rome

Perfectly located in a safe and quiet but extremely central Rome neighborhood, the Chaplin Bed and Breakfast Rome is the ideal base for your Roman holiday.

Casa Villatalla B&B, Liguria

By far the most important members of the Casa Villatalla household are Nellie (an elderly but loveable chocolate Labrador), Bonnie, a fluffy and rather scatty American Spaniel, and Pickle, aneccentric cat who walks like John Wayne.