The codice fiscale or Italian tax code which some Italian shopping and travel web sites require before certain operations can be carried out has caused a number of readers problems when they want to pay fines, buy tickets to museums in Florence, Venice and Rome and shop online in Italy.

Online stores or online ticket sales services based in Italy may request an Italian tax code before any purchase can be made. No codice fiscale, no ticket for an interesting attraction, or no interesting wine from a producer in Italy.

September 2015 update: I mentioned the codice fiscale issues to someone who works for a major credit card issuer and processor in Italy. Very kindly, this gentleman, Luca Gentile, carried out some inquiries. He told me that there’s no obligation under Italian law for e-commerce websites based in Italy to request an Italian codice fiscale tax code from purchasers who are not Italian. Even Italian law acknowledges that non-Italians cannot be expected to possess Italian tax codes. What this means is that there is no need for Italian websites to request a codice fiscale from foreign purchasers. The problem is that may do, most probably because they do not, on the face of it, expect foreign purchasers. Except some obviously do because sections of websites may well be available in English and other languages.

What does this mean to anyone creating a codice fiscale to shop on Italian websites? Well, by creating a codice fiscale, they are probably not (but I need to ask lawyers about this and will do) breaking any Italian laws because they are a) not Italian and b) not resident in Italy.

Hopefully, Italian e-commerce websites will wake up and stop asking foreign shoppers for a codice fiscale – who knows just how many sales have been lost because a codice fiscale is requested? I’m willing to bet it’s a lot and this post on the subject has been around since 2008 and, in 2015, it continues to get lots of visitors daily.

I checked the website of the Doge’s Palace in Venice and a website selling tickets for the Uffizi Gallery and other attractions in Florence. Thankfully, neither now request an Italian codice fiscale tax code for purchasers located in the United States and United Kingdom. End of update.

Note that if you are not based in Italy, you may be able to ignore codice fiscale tax code fields in online forms and still be able to complete purchases. If you are unable to proceed with a purchase from an Italian website – which may well be why you arrived here – then read on.

At the end of this article, you’ll also find instructions on how you might be able to recover a lost officially issued Italian tax code – codice fiscale.

What is the Italian Tax Code – Codice Fiscale?

The Codice Fiscale is an alpha numeric code which is assigned to all Italians at birth. Anyone who comes to live and work in Italy will need an Italian tax code. I have one, even though I am not Italian.

If you are not Italian, or not resident in Italy, you will not have an Italian tax code. This means you may not be able to use Italian websites which request an Italian tax code before you can buy things like goods offered for sale by Italian ecommerce websites, advance tickets to Italy’s museums and other tourist attractions.

If you need a real Italian tax code (codice fiscale), you will also find instructions in this post on where to go to get one.

Before explaining how to use an online system to create a codice fiscale, be aware that if you ever need a real Italian tax code, the one you create using the system mentioned here may not be 100% accurate.

Problems can occur if more than one person has a similar name and surname, was born on exactly the same date and in the same ‘commune’. OK, so these situations are going to be rare, but I thought I should mention this – just in case.

Note, again, that the code you create with this system is not official – to create a real codice fiscale you need to come to Italy, get up early and go stand in a queue – see below.

Note too, if you are in Italy and you try to use the codice fiscale you create with the system below as a legal tax code, you may well end up with a visit from Italy’s police – be warned.

Incidentally, I used the system below to calculate my own codice fiscale and the result was exactly the same as my actual official Italian codice fiscale code – but this is not always the case. As I mentioned at the start of this ‘how to’, I have a codice fiscale because I live and work in Italy, even though I am not Italian.

Information on how to obtain an official codice fiscale follows the unofficial codice fiscale creation section.

Now, if you just want an unofficial Italian tax code to use on some Italian online store or other, here is how you can do it:

How to Get Tax Code – Codice Fiscale?: Step By Step Guide

Remembering that this process will not create an official Italian tax code – Codice Fiscale (Yes, I know I keep repeating this – if I don’t, you may forget, and moan), first of all, you will need to go to this site: http://www.paginebianche.it/codice-fiscale (The link will open in a new window/tab, so you can refer to the instructions which follow.)

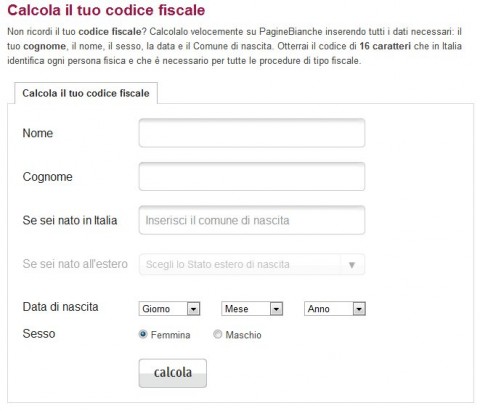

After you click, you should see a screen which looks something like this:

Now, here are instructions on how to use the Italian tax code calculation system.

First, enter your:

- Nome = First Name (from your passport) – Mark

- Cognome = Surname – Jones

- Sesso = sex – select Femmina, if you are a woman, or Maschio, if you are a man. Femmina may be pre-selected.

Ignore the ‘Se sei nato in Italia‘ box, unless you were born in Italy. Instead, do this:

- Click on the greyish ‘Se sei nato all’estero‘ box. At first glance it does not look as if it will not work, but it will.

- A drop down menu will then present you with a choice of countries. Choose yours – you will need to know the Italian name for your nation. ‘Gran Bretagna’ = Great Britain, ‘Stati Uniti’ = United States, etc, etc.

Enter your Data di Nascita – Date of Birth

- First box – Giorno = day – select a number eg 21

- Second box – Mese = month – select a month eg Aprile (April)

Stop reading, start speaking

Stop translating in your head and start speaking Italian for real with the only audio course that prompt you to speak.

Months in Italian and English

Gennaio – January

Febbraio – Feburary

Marzo – March

Aprile – April

Maggio – May

Giugno – June

Luglio – July

Agosto – August

Settembre – September

Ottobre – October

Novembre – November

Dicembre – December

- Third box – this is where you select the year you were born.

Next, click on the ‘Calcola‘ button. Again, note that this does not create an official Codice Fiscale, as has already been pointed out more than a few times.

Below the form you have just completed you should see your very own, unofficial, Italian tax code – codice fiscale –

Your unofficial Codice Fiscale should look something like this: JNS JHN 67B02 Z404Z – 6 letters, then numbers and letters.

Make a note of the code.

Now you can whiz off to acquire an unlocked Apple iPhone, buy a ticket to the Doge’s Palace Venice, or order something from an online shop based in Italy which asks you for an Italian tax code.

Why Do You Need the Codice Fiscale?

The Codice Fiscale is a vital identifier in Italy, akin to a tax code used for a myriad of essential transactions. Required for both Italians and foreigners residing or engaging in activities within the country, it serves as a unique identifier for legal and financial operations.

From purchasing tickets to museums or tourist attractions, shopping on Italian websites, to official business dealings, the Codice Fiscale is a prerequisite, ensuring smooth and legitimate transactions in various spheres of life in Italy.

If You Need an Official Italian Tax code – Read This

PLEASE NOTE: The system mentioned on this page does not produce an official Italian tax code (Codice Fiscale). If you need an official Codice Fiscale, then you must go to the offices of the Agenzia Delle Entrate. There is more information, in English, on the Italian Agenzie Delle Entrate website: Health and Tax Code Section – note that the address of this web page changes from time to time. If the link does not work when you click, let me know via a comment. Link last checked on April 7th, 2015.

What Do You Need to Get a Codice Fiscale?

To get a real codice fiscale, you will need an identity document. A passport, or birth certificate for young children, will be enough.

It is possible to obtain a Codice Fiscale via the Italian consulate in London in the United Kingdom. Instructions on how to do this can be found here. Your United Kingdom issued Codice Fiscale will take between one and a half and two months to arrive.

In Italy, if you are lucky, you can get one in a morning.

Other Italian consulates and embassies around the world may also offer a similar codice fiscale creation service.

Get there Early

The offices issuing the codice fiscale in Italy are usually open from 8am in the morning until 1pm in the afternoon. It is a good idea to get there at or before opening time – or you may have to come back the next day. In the bigger Italian cities, queues are likely to be long meaning that a morning off work is advisable. If you tell your Italian boss where you are going, he or she should understand. Many companies in Italy will help you with the creation of a codice fiscale, and may even go do the queuing for you.

The codice fiscale serves in Italy as both a tax and health code.

Have You Lost Your Official Codice Fiscale?

At some time in the past, maybe you came to Italy and worked for a while, as an English teacher, perhaps. If so, you were probably issued an official Italian codice fiscale. Years later, you want to purchase something online from Italy and you cannot find your Italian tax code. It happens.

In this case, first of all try to find some official documentation which may contain your codice fiscale – you may find it on utilities bills, mobile phone contracts, invoices, or old tax documents. If however, you cannot unearth your long lost Italian codice fiscale, here’s something else you can try.

First of all, use the system described on this page to re-create your codice fiscale and then visit Italy’s official codice fiscale checking system which is here: Verifica codice fiscale di persona fisica o di soggetto diverso da persona fisica – the page is in Italian but it’s not hard to use:

- Enter the codice fiscale you want to verify in the box next to where it says ‘Codice fiscale’.

- Then enter the security code – codice di sicurezza – in the box next to the words “codice di sicurezza”. You may find the security code a little hard to read, so several attempts may be necessary.

- Finally, click on ‘invia’ – submit, and the system will check your codice fiscale. If all goes well, you will see a message like this:

La verifica per il codice fiscale <the codice fiscale you are checking> ha prodotto il seguente risultato:

CODICE FISCALE VALIDO

The words “Codice Fiscale Valido” indicate that the code you are checking is valid. Well done, you have found your old Codice Fiscale tax code. The only problem is that the official system does not tell you the name of the person who holds the verified code. You can be around 99% certain that the person is you though.

I hope all this information helps. And you might find this post: How to Avoid Fines while Staying in Italy useful too – assuming you’ve arrived here before being fined, that is.

If you have problems, let me know and I will try to help you.